In the digital age, people can communicate with each other in real-time, 24/7, from anywhere with internet connection using various means such as messaging apps, and social media. Digital payments are also becoming ubiquitous in many jurisdictions, allowing payments that are instant, real/time, 24/7, from anywhere with internet connection.

Digital payments fundamental: It’s all about messaging and double entry bookkeeping, money hardly moves

One key commonality between digital communication between messaging apps and digital payments is that both are essentially transmission of messages. On the one hand, messaging apps transmit whatever personal message an individual wants to make. Digital payment systems, on the other hand, transmit payment instruction messages between end users and financial intermediaries.

In digital payments, a payment message could be sent from an end user in an instant, via a mobile phone app, to the payment service provider. If both the payer’s and the payee’s accounts are with the same payment service provider, this would simply trigger the payment service provider to instantly debit funds from the payer’s account and credits the same amount of funds into the payee’s account, according to payment instruction. The whole process is essentially a double entry booking operation, enabled by digital messaging. The debit and credit will alter the record of available funds in both the accounts of payer and payee at the payment service provider. No money actually moves between the two accounts, although the record of funds ownership at the payment service provider changes.

In contrast, if the payee’s account is with another payment service provider, then apart from debiting fund of the payer’s account, the payer’s payment service provider needs to send a payment instruction to the payee’s payment service provider, requesting funds to be credited into the payee’s account. Here, there is an extra set of double entry bookkeeping operations needed to help settle the transaction. At the gist, the payer and and payee will need to have account at a central settlement agent. For simplicity, it might be assumed that the central settlement agent is the central bank. In addition to sending a payment instruction message to the payee’s payment service provider to debit funds into the payee’s account, the payer’s payment service provider will need to send another message to the central bank instructing the central bank to debit funds from its account at the central bank and debit them into the account of the payee’s payment service provider at the central bank as per the amount of the payer’s payment instruction.

Double entry bookkeeping done this way ensures that all the relevant accounts are balanced after the transaction is executed. The payer’s payment service provider’s assets at the central bank will decrease by the same amount as the decrease of its liability to the payer who has already paid out the funds from her account. The payee’s payment service provider’s assets at the central bank will increase by the same amount as the increase of its liability to the payee who has received the funds into her account.

Again, even when the payment is done across payment service providers, the whole operation is largely a double entry bookkeeping operation enabled by instant messaging. Arguably, the move of money only occurs at the link where the central bank debits funds from the payer’s payment service provider’s account at the central bank, and credits them into the payee’s payment service provider’s account at the central bank. Funds held in the payment service providers’ accounts at the central bank are considered central bank money. The debit and credit of funds between the accounts at the central bank is where money actually moves in this case.

So, if messaging apps allow messaging to be done instantly, 24/7, then digital payments between bank accounts in the same jurisdiction have the potential to be also done instantly if double bookkeeping entry can be executed digitally. The emergence of “instant payment systems” or “faster payment systems” in many jurisdictions reflect such developments (although the settlement of funds at the central settlement agent among the regulated payment service providers might be done at pre-specified intervals rather than instantly to save costs).

These instant payment systems often charge low or no fees on users. The question now is, why can’t payments between payer’s and payee’s accounts that reside in different jurisdictions be made instant 24/7 at low or no costs as well? Here, the situation becomes complicated since the payer’s bank might not have a direct relationship with the payee’s bank. Furthermore, there might not be a central settlement agent helping to facilitate settlement of payments between the banks in different jurisdictions.

Cross-border digital payments: Correspondent banking model

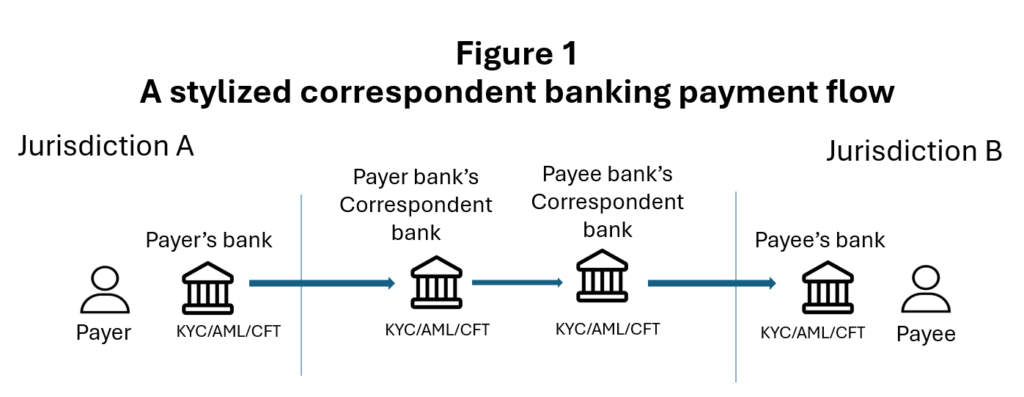

Currently, cross-border payments rely mainly on the correspondent banking model. In a correspondent banking model, if there is no direct relationship between the payer’s bank and the payee’s bank in two jurisdictions, the payer’s bank will need to send its payment instruction along a chain of correspondent banks (possibly in multiple jurisdictions) to reach the payee’s bank in the destination jurisdiction. Likewise, the settlement would be done through a chain of double entry bookkeeping among the correspondent banks.

In a typical correspondent banking model, the payments are not likely to be instant, 24/7, and could be costly, given that a payment message has to pass through multiple banks along the chain. See Figure 1 below for an illustration. In a correspondent banking payment flow, each of the correspondent banks will have to complete their know-your-customer (KYC), anti-money laundering and counter-financing of terrorism (AML/CFT) requirements, repeating the process along the way.

Instant cross-border digital payments: The alternatives

With recent advancements in technologies, to ensure that cross-border payments can be made in an instant manner with a lower cost, there are multiple alternatives to the correspondent banking model being explored by both the public and private sectors globally.

- First, cross-border instant payment systems linkages could be adopted. This is an application of the instant messaging paradigm plus double entry bookkeeping for cross-border payments. Jurisdictions involved would need to ensure that their payment messaging standards, as well as technical and KYC/AML/CFT standards are interoperable. Examples of this paradigm include PromptPay-PayNow, the bilateral instant payment linkages between Thailand and Singapore, and Project Nexus by the Bank for International Settlements Innovation Hub which aims to do multilateral instant payment systems linkages.

- Second, private sector player might also come in and be a bridge across payment systems of various jurisdictions. For example, a FinTech player might partner with local banks in multiple jurisdictions, and through its own proprietary system, receive a payment from the payer, do their internal double entry bookkeeping between the payer and payee jurisdictions, and instruct its partner bank in the receiving jurisdiction to make a payment to the payee’s account through the receiving jurisdiction’s domestic payment system.

- Third, jurisdictions might opt for a whole new cross-border payment system architecture based on central bank digital currency (CBDC). This might involve the use of a distributed ledger technology (DLT), where rather than having a payment message sent across a chain of payment service providers, the ownership of funds is transferred directly via the transfer of ownership of CBDC represented on a common ledger distributed among different participants in different jurisdictions. Project mBridge is an example of this paradigm.

- Fourth, private sector players might also adopt a whole new cross-border payment system architecture, based on stablecoins or tokenized deposits. Both stablecoins and tokenized deposits would also involve the use of distributed ledger technology, whereby the change in ownership of funds across border is made by the transfer of stablecoins or tokenized deposits represented on a common ledger distributed across different jurisdictions.

In the Part II, we will discuss these cross-border payments alternatives in more detail.